The 2024 UK-budget

18th November 2024

Rachel Reeves, the UK’s first female Chancellor, delivered the Labour Party's first Budget in 14 years. Her aim was to create a stable economic environment, boost business confidence and encourage foreign private investment to produce sustainable economic growth.

The Budget plans for increased government spending (2% of GDP annually) focused on infrastructure, housing, and R&D. To cover these costs, taxes will rise (particularly National Insurance contributions and capital gain taxes) alongside increased borrowing. The Chancellor sees this as a path to fiscal and economic stability.

The government will focus investment on several key sectors: advanced manufacturing, creative industries, clean energy, defence, digital and technology, financial services, life sciences, and professional and business services.

Focus on government investment

Government spending will increase by around 2% of GDP a year, on average, over the next five years. One-third of the additional spending will go on government investment spending on things such as transport, housing, and research and development (R&D). The remaining two-thirds will go on governmental day-to-day spending. Key Investment Initiatives announced include:

A National Wealth Fund

The UK government has established a National Wealth Fund (NWF) to invest in long-term infrastructure projects and attract private investment. The existing UK Infrastructure Bank will be expanded and renamed as the NWF, with an additional £5.8 billion in capital. This investment is expected to generate returns, offsetting borrowing costs and reducing government debt by up to £135 million annually by 2029/30.

Planning Reform

It has been said that the complicated planning process has hindered investment and project progress. The government is streamlining the planning process to accelerate infrastructure projects. Six Nationally Significant Infrastructure Projects have already been approved.

Science and Technology

£20.4 billion is allocated for R&D in 2025-26, including £6.1 billion for core research. Additionally, £25 million is earmarked for a new R&D Missions Programme. There was a commitment to continue participation in the Horizon Europe research programme, ongoing support for the National Institute for Health and Care Research (NIHR) to drive life sciences innovation, research into nuclear fusion based power generation, launch of an AI Opportunities Action Plan and creation of a National Data Library to unlock the value of public data.

Energy and Green Technology

£3.9 billion is allocated for Carbon Capture, Usage and Storage (CCUS) projects, £125 million for Great British Energy, and £2.7 billion for the Sizewell C nuclear power station. A further £3.4 billion will be invested in heat decarbonisation and energy efficiency improvements, including £1.8 billion for fuel poverty schemes. The government will invest £134 million in port infrastructure to support offshore wind projects and £163 million to help industries decarbonize. Additionally, funding will be provided for the first round of electrolytic hydrogen production contracts, leveraging renewable energy. Other investments include £5 billion for sustainable agriculture in England, £400 million for tree planting and peatland restoration and £2.4 billion for flood resilience measures.

Electric Vehicles

The government reiterated that from 2035 all new cars and vans sold in the UK will be zero emission and to facilitate the transition to EVs, announced a plan to invest over £200 million in 2025-26 to expand the EV charging network. Additionally, £120 million will be allocated to support the purchase of electric vans and wheelchair-accessible EVs. To further incentivise EV adoption, tax breaks for electric car purchases and chargepoint installations will be extended.

Economic projections

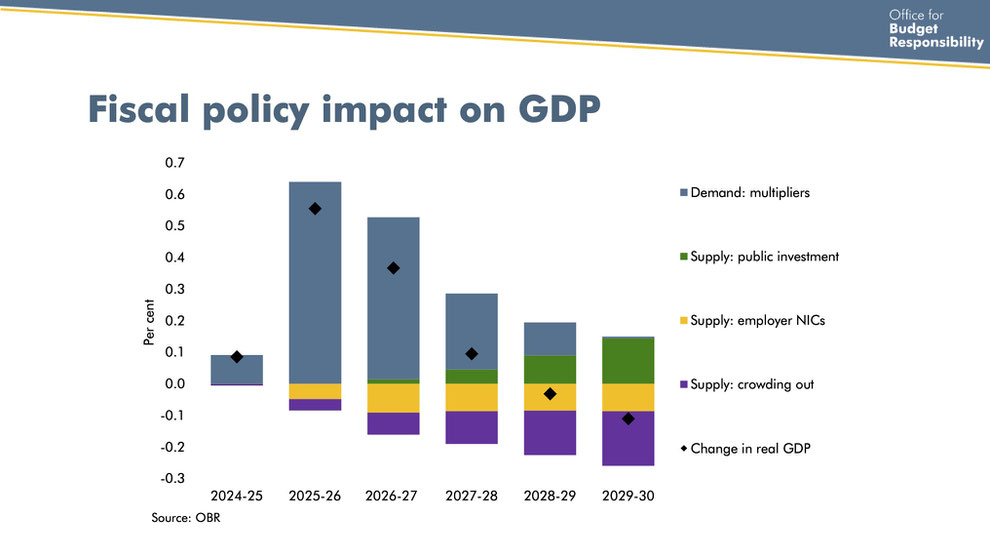

The UK's Autumn Budget 2024 forecasts a period of economic growth, with GDP expected to rise in the coming years. However, increased government spending and taxation will contribute to higher inflation. The Office for Budget Responsibility's (OBR) economic projections are more optimistic than those of other forecasters, including the Bank of England, which forecast lower growth rates. The OBR analysis concluded that the extra government borrowing delivers a temporary boost to the economy with real GDP growth rising from 1.1 per cent this year to 2 per cent next year. But budget policies leave the level of output largely unchanged in the final year of their forecast.

In its Fiscal Outlook, the OBR predicts, that the budget's fiscal loosening will temporarily boost GDP by 0.5% in 2025. However, this effect will fade by 2030 as monetary policy and rising prices crowd out private spending.

Source: Office of Budget Responsibility

This Budget boosts potential output by 0.1% through increased public investment. However, higher employer NICs reduce employment and potential output by 0.1%. Increased public spending crowds out business investment, reducing output by 0.2%. This initially boosts GDP but has no long-term effect. The OBR suggests that extending current government investment beyond 2030 could lead to a positive impact on the UK's GDP in the early 2030s, driven by increased public capital stock.

The key tax changes

The chancellor announced a set of tax changes that would raise an additional £36.2bn, or just over 1% of GDP, a year on average in additional revenue:

Increased Capital Gains Tax (CGT) Rates

The main rates of CGT were increased from 10% and 20% to 18% and 24%, respectively.

Non-Dom Tax Reform

The government abolished the remittance basis of taxation for non-UK domiciled individuals, replacing it with a residence-based system.

Increased Employer National Insurance Contributions (NICs)

Employer NICs increased by 1.2 percentage points to 15%, and the threshold at which employers start paying NICs was reduced from £9,100 per year to £5,000 per year.

Changes to Inheritance Tax (IHT)

IHT will now apply to unspent pension pots, and there are changes to agricultural property relief and business property relief.

Employers have warned that they will struggle to cope with the increase in social security contributions that form most of the revenue that Reeves plans to raise in tax. Reacting to the Chancellor’s Autumn Budget, Shevaun Haviland, Director General of the British Chambers of Commerce, said: “While some protection for smaller firms is welcome, the increase in employer National Insurance Contributions will place a further cost burden on business. This, coupled with a 6.7% increase in the National Living Wage, means many firms will find it more challenging to invest and recruit in the short-term”. The increased costs on businesses may end up being passed on to consumers, and hence, inflation is expected to remain elevated in the short term.

New Fiscal Rules

The Chancellor has introduced two new fiscal rules to allow for the additional borrowing:

- The current budget, or the difference between day-to-day spending and revenue, should be in surplus, and the government will only borrow for investment.

- Government net financial liabilities, the difference between its debts and its financial assets, should decrease as a proportion of GDP. This rule uses a broader definition for Government debt than in previous policy, which is known as public sector net financial liabilities (PSNFL) which measures the government’s debt and other financial liabilities minus its liquid financial assets. It also recognises illiquid financial assets, such as equity holdings and loans, which are netted off debt to calculate the measure of the balance sheet. This means that financial investments which make a return above the cost of borrowing will reduce the debt burden.

The OBR forecasts a significant increase in government borrowing in 2024/25, reaching £127 billion. While borrowing is expected to decrease in subsequent years, it will remain elevated compared to previous forecasts. This increase is primarily due to higher government spending outpacing tax revenue. Government debt, as a percentage of GDP, is expected to rise slightly in the short term but then stabilize and gradually decline over the forecast period.

Our Views

From our discussions with government officials and industry leaders, we have the impression that the government has worked closely with industry. As described in the Budget, investment is focused on sectors which are seen as key to the UK’s technological and industrial strengths. Whilst the jury is still out on whether the budget measures will stimulate the economy to the extent the government wants, the government has demonstrated intent to establish a stable investment environment within a defined industrial sector framework. Prior to the Budget, the government has released an open consultation, “Invest 2035: the UK’s modern industrial strategy” on the 24th October. The Industrial Strategy, alongside focused sectors, will be announced in spring 2025.

We closely monitor the impact of the Budget and the Industrial Strategy on the UK economy and businesses, and how this differentiates the results of the new government from the previous administration.

Contains public sector information licensed under the Open Government Licence v3.0.

The full budget statement may be read here: https://assets.publishing.service.gov.uk/media/672232d010b0d582ee8c4905/Autumn_Budget_2024__web_accessible_.pdf

The UK Office of Budget Responsibility October 2024 Economic and Fiscal Outlook presentation.

https://obr.uk/docs/dlm_uploads/Presentation_slides_October_2024.pdf

Open Consultation: Invest 2035: the UK’s modern industrial strategy

https://www.gov.uk/government/consultations/invest-2035-the-uks-modern-industrial-strategy/invest-2035-the-uks-modern-industrial-strategy

Contains public sector information licensed under the Open Government Licence v3.0.